Group Life Insurance

Group life insurance that provides more than just financial protection.

With a broad range of policy options, our life insurance is designed to work for small businesses and large employers alike.

Group life cover is one of the most important insurance products a company can have, easing the financial pressures on an employee’s family in the event of their death. The benefits can be paid as a lump sum, pension, or both - depending on your client’s needs.

Product features

- Competitive pricing

- Straightforward online setup and administration

- Market leading support services

- Wide range of policy options available, including support services

- Trust options: registered master trust or excepted life trust

Excepted Life Trust

Whether your clients are new or existing excepted group life policyholders, the excepted life trust is available to them at no extra cost.

With this service, your clients can be sure their trust deed is properly worded and that professional trustees will be on hand if a death happens (provided by Zedra Governance Ltd (Zedra)).

This helps to speed up beneficiary payments.

Master Trust

Maintaining a group life trust and acting as trustees in the event of an employee’s death can be daunting. That’s where professional trustees Zedra come in.

For registered group life assurance schemes this is a single trust which is set up and administered by professional trustees, Zedra. Either new or existing schemes can opt to join the trust at no extra cost. Employers do not need to maintain their own trust or act as trustees in the event of a death, this is done by Zedra.

- There’s no need to wait for HMRC registration

- There’s no need to set up a trustee bank account

- There’s no need for an employer to act as trustees

- Schemes can go on-risk quicker, with no extra forms required

- Trust deed and rules are kept up to date

How your clients can establish an Excepted Life Trust

For a new policy:

- Download the excepted life trust deed.

- Open the PDF and complete the grey fields in the document (REGNUMBER is the Companies House registration number for the company).

- Indicate the date you wish to start the new trust in the grey date field ‘StartDateofPolicy’ (the trust can’t be backdated, so please use a date in the future).

- Save the PDF, print and sign it.

- Scan the signed document and email it to groupquotes@aiglife.co.uk with your completed application form, prior to the policy start date.

For an existing policy:

- Download the excepted life trust deed.

- Open the PDF and complete the grey fields in the document (REGNUMBER is the Companies House registration number for the company).

- Indicate the date you wish to start the new trust in the grey date field ‘StartDateofPolicy’ (the trust can’t be backdated, so please use a date in the future).

- Save the PDF, print and sign it.

- Scan the signed document and email it to groupclientservice@aiglife.co.uk with your policy number.

How to complete the Excepted Group Life trust document

We’ve put together a guide to help you complete the document

Smart Health: the perfect blend of services to help manage health and wellbeing

And it's free to your clients and their families too. They can use it as much as they need, whether that's now or in the future. Smart Health is more than a wellbeing service - it's a GP with 24/7 availability, as well as a fitness coach, nutritionist and mental health supporter, accessed on the go, at any time. Health has never been so convenient.

This is Suzanna. Suzanna lives in Yorkshire.

She’s got a new job in London and commutes on the train.

She knew something wasn’t right with a funny spot on her forehead that wouldn’t go away.

She struggled to get a convenient Doctors appointment in between juggling work but knew something was really wrong when the spot got bigger.

Suzanna remembers she’s got Group Life cover with AIG Life through her employer. In the hotel that night she reaches for her phone to make a convenient appointment.

Suzanna feels Smart.

Get Smart Health from AIG Life. Whatever the time.

Smart Health offers employees access to six personalised services, including nutrition plans and workout programmes, to help ward off illness, as well as a second medical opinion service. But most importantly, they have 24/7 access to a GP. Whether it's over the phone or via video call, employees can speak to a medical professional wherever they are. All insured employees can benefit from Smart Health.

Additional support services

Bereavement helpline

This service offers all group life clients, their employees and families access to a completely confidential bereavement helpline and telephone counselling. It’s designed to support employees and their families following the loss of a loved one, whether that be through developing support strategies or referral to therapy.

Probate helpline

Our free-to-use probate helpline can help employees and their families understand the process for obtaining probate following a bereavement. Employees have unlimited access to the telephone helpline to provide them with support and guidance to navigate the legal, financial and tax issues resulting from a death.

Winston's Wish

We’re also proud to work with Winston’s Wish – the leading UK charity helping bereaved children get the specialist help they need when coping with grief.

Cover options

- Available for three employees or more, with no maximum

- Insured as a lump sum or death-in-service pension

- Cover available up to age 75

- Accurate premium calculations - no averaging

- Up to 20x salary available, or any fixed benefit amount

- Premium rates are guaranteed for two years

- Straightforward individual assessment completed online

- Competitive automatic acceptance limit for all schemes

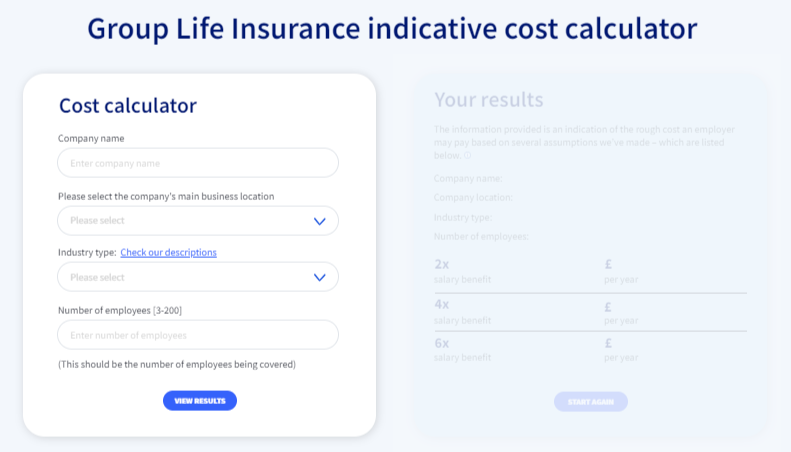

What it might cost

All you need to do is add a few bits of information about an employer and their workforce into the calculator and you’ll get a rough annual premium for our Group Life Insurance scheme.

Get in touch

To get a quote for a client, give us a call on 0330 303 9978 or email us at groupquotes@aiglife.co.uk

If you're quoting for a scheme of up to 200 employees, visit our online portal to get a quote now.

Group life information to share with your clients

If your clients are looking to purchase group life insurance, share our animation with them, which explains all of the benefits group life has to offer.

You can also point them to our ‘why buy group life’ page, highlighting the value of group life for a company and it’s employees.

Literature and support materials

Registered Group Life - Technical guide

An overview of the Registered Group Life policy. Policy aims, how it works, what is covered and premiums charged.

Excepted Group Life - Technical guide

This guide is a comprehensive overview of our Excepted Group Life product.

Master Trust deed

A document about AIG Group Protection Master Trust deed.

Master Trust FAQs

This document provides a list of questions and answers about trusts.

Registered Group Life - Product summary

An overview of the key features of our Registered Group Life product.

Excepted Group Life - Product summary

This document is a high level outline of our Excepted Group Life product. For full information please refer to the technical guide or policy terms and conditions.

Registered group life and DISP – product summary

An overview of the key features of our registered group life & DISP product.

Group Life - sales aid

Read our sales aid for group life, explaining all of the benefits this product offers your clients and their employees.