High Net Worth

We know it’s important that you get it right first time for your High-Net-Worth (HNW) clients. That’s why our HNW products combine excellent service with the high levels of cover you’re looking for.

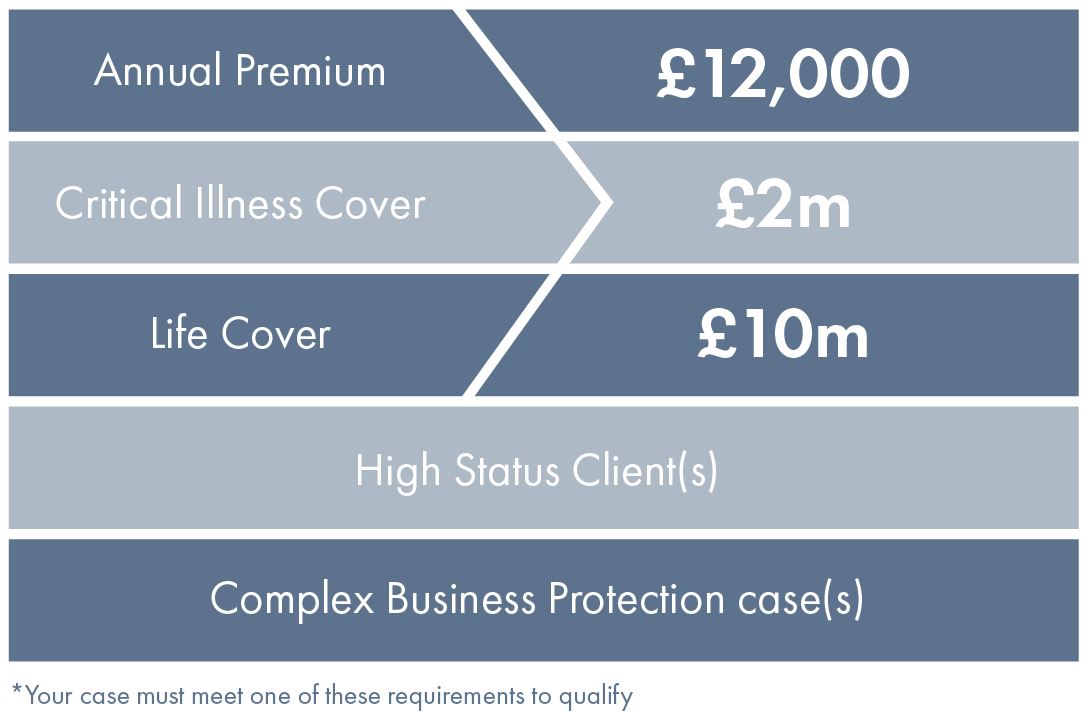

We can offer cover up to £100m Level Term, £52m Whole of Life and £3m Critical Illness, £10m (commuted value) Family Income Benefit and £250,000 per annum Income Protection. Your case* will be assigned to our premier service team. The team of expert underwriters and administrators will be dedicated points of contact for your case. They'll liaise directly with you throughout the application process, providing any support you need as well as frequent updates.

Financial underwriting

Our financial underwriting limits meet the needs of HNW individuals. We won’t ask any financial questions below £1.25m Life or £650,000 Critical Illness, and only require financial evidence for cases over £3.5m Life or £1.5m Critical Illness.

We don't ask for a paper financial questionnaire or for a General Practitioner’s Report (GPR) - regardless of the sum assured or age of the client.

Your client will receive Immediate Cover, which is a temporary cover while the application is being assessed. Our Immediate Cover is valid for up to 90 days from the date of a fully completed application, subject to certain exclusions.

They can receive up to a maximum of the sum assured or: